Tokenomics¶

The EMBR token is the governance token for the Embr Finance protocol. EMBR liquidity stakers will also eventually collect a portion of protocol fees decided by the DAO. EMBR has a total maximum supply of 25,000,000.

Initial Supply¶

The initial mint will be 22% of the maximum supply and will be broken down as follows:

| Allocation | % of Supply | Amount Of Tokens |

|---|---|---|

| Liquidity Bootstrapping Pool | 2.0% | 500,000 |

| Vested Team Funds | 11% | 2,750,000 |

| Funding Rounds | 4% | 1,000,000 |

| Strategic Partnerships | 4% | 1,000,000 |

| Launchpad Event | 1% | 250,000 |

Note: Of the 22% minted, only 2.65% will be in circulation upon launch; all other tokens will follow the vesting schedules described below.

NFT Drop¶

The private and public rounds will be distributed using an NFT Drop. EMBR will be loaded onto the NFT, and the owner will be able to directly redeem their EMBR from the NFT contract form the Avaware dapp.

EMBR private round NFTS will become redeemable 30 days after the initial LPB pool launch. EMBR public round NFTS will become redeemable 24-48 hours after the initial LPB pool launch.

- NFT can be used to stake on Avaware & as a collectible!

- NFT can be bought and sold on Avaware NFT market for AVAX, AVE, or AUSD.

Private Round¶

750k EMBR allocated for private sales.

Proceeds will be used to fund the Liquidity bootstrapping pool and will be transferred from the LBP into an 80/20 EMBR/AUSD weighted pool following the conclusion of the LBP.

- 1 Private Round NFT @ 5000 AUSD ea. for 33500 EMBR

- 22 Private Round NFT --available-- (total)

Public Round¶

250k Tokens For AvalancheFriends Ticket Redeem

- 250 Public Round NFTs @ 500 AUSD ea. for 1000 EMBR (0.50c)

- 1,000 EMBR will be easily claimable from within Avaware.Network NFT Wallet

Avaware Launchpad Event¶

250k EMBR allocated for Avaware launchpad event.

- Users will stake AVE/EMBR EPT and get rewarded in EMBR

- Event will start Monday, Dec 20th, 2021.

- Event will last 30 days.

Liquidity Bootstrapping Pool (LPB)¶

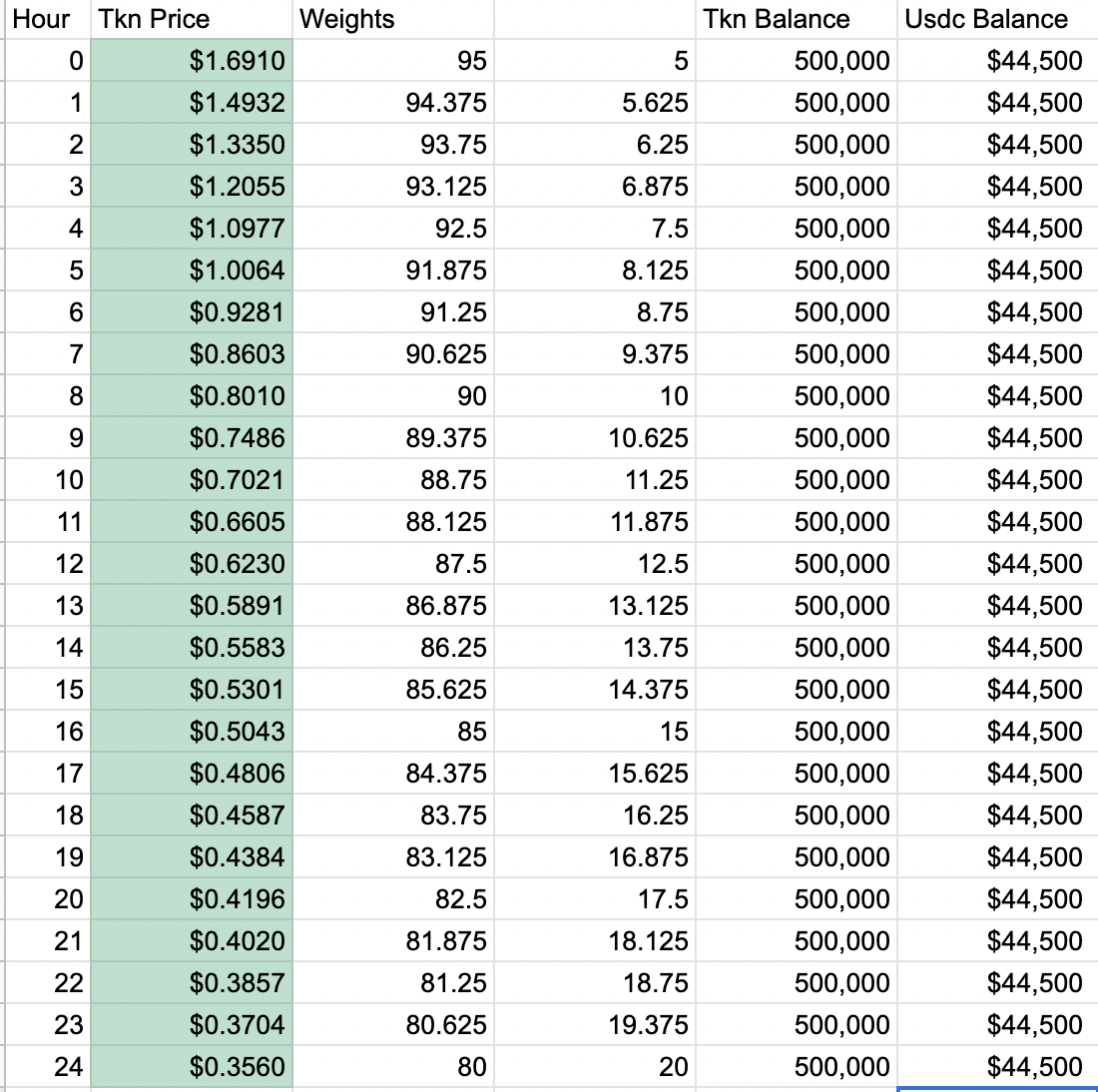

The Liquidity Bootstrapping Pool will use the allocated 2% of the Total Max Supply of EMBR (500,000 EMBR) and $44,500 worth of AUSD.

- 500k EMR tokens will be distributed using a Liquidity Bootstrapping Pool (LBP). The exact date and time will be announced.

- The LBP will run for 24 hours and is open to anyone.

- The LBP is not like a regular weighted pool. The price will start very high to disincentivize bots, front-running, and speculation. Over time, the price will automatically decrease by design.

- Below is a graph that shows the EMBR/AUSD pool weight starting at 95/5 (with a high EMBR price) and declining to 80/20 (lower EMBR price) over 24 hours.

- At the end of the 24 hour period, the funds will be transferred from the LBP into an 80/20 EMBR/AUSD weighted pool.

- The LP tokens received by the development team for making the initial pool will be deposited into the EMBR/AUSD.

- NOTE: the graph below assumes no buy/sell orders; the price will very likely fluctuate at variance with the below model as we expect buying pressure to occur. The models below only illustrate the basic operation of the LBP function.

Vested Team Funds¶

The team funds will be vested linearly and will be distributed according to the following schedule:

- 27 % Initial Allowance ( 750,000 )

- 73 % Vested Lineraly over 4 years ( 2,000,000 )

Both the team wallet and vesting contract will be made available in the documentation.

Strategic Partnerships¶

This fund will be deployed to attract and incentivize strategic partners to help Embr grow and thrive. In addition, 4% of the total maximum supply will be reserved to promote ecosystem partnerships.

| Allocation | % of Supply | Amount Of Tokens |

|---|---|---|

| Vested Partnerships | 4.0% | 1m |

Embr finance will never use any of the funds in the Strategic Partnerships Fund to pay or reward any of its team members or employees. This fund is exclusively for partners, integrators, and other teams in general that contribute to the Embr ecosystem. Any use of these funds will be presented to the community before execution.

Token Emissions¶

After the initial mint, the remaining supply will be emitted over four years, following our Token Emissions. The emissions will be distributed as follows:

| Allocation | % of Supply |

|---|---|

| LP Farm Rewards | 68.0% |

| Treasury Funds | 10.0% |

See the Token Emissions section for more details.